U.S. CPA

US CPA Certification Course in Bangalore Earn the highest accounting credential in the USA—the global equivalent to the Indian CA.

Ample's

Ample Training Institute offers comprehensive U.S. CPA training in Bangalore, designed for students pursuing a globally recognized CPA certification course in India.

How to Become a US CPA : Step-by-Step Guide?

Higher Salary and Better Career Growth

➔ Opens up doors to senior level roles like Finance Manager, CFO, Director of Finance, faster!

➔ Earn 20-40% more than your non-CPA counterparts.

Global Recognition & Job Opportunities

➔ US CPA is globally recognised including Canada, Australia, and the Middle East as well as the USA.

➔ High demand in MNCs Big 4(Deloitte, PwC, EY, KPMG), & Fortune 500 companies.

Shorter and More Flexible Than C.A. Exam

➔ US CPA, for those meeting US CPA eligibility, can be completed in 12–18 months, unlike CA, which takes 4–5+ years.

➔ Only 4 exams to clear, unlike CA, which has multiple levels.

Edge Over CA in MNCs & US-Based Companies

➔ Preferred for roles in US Taxation, International Accounting, Auditing & Consulting.

Meet Our Lead Instructors

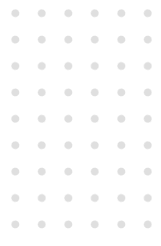

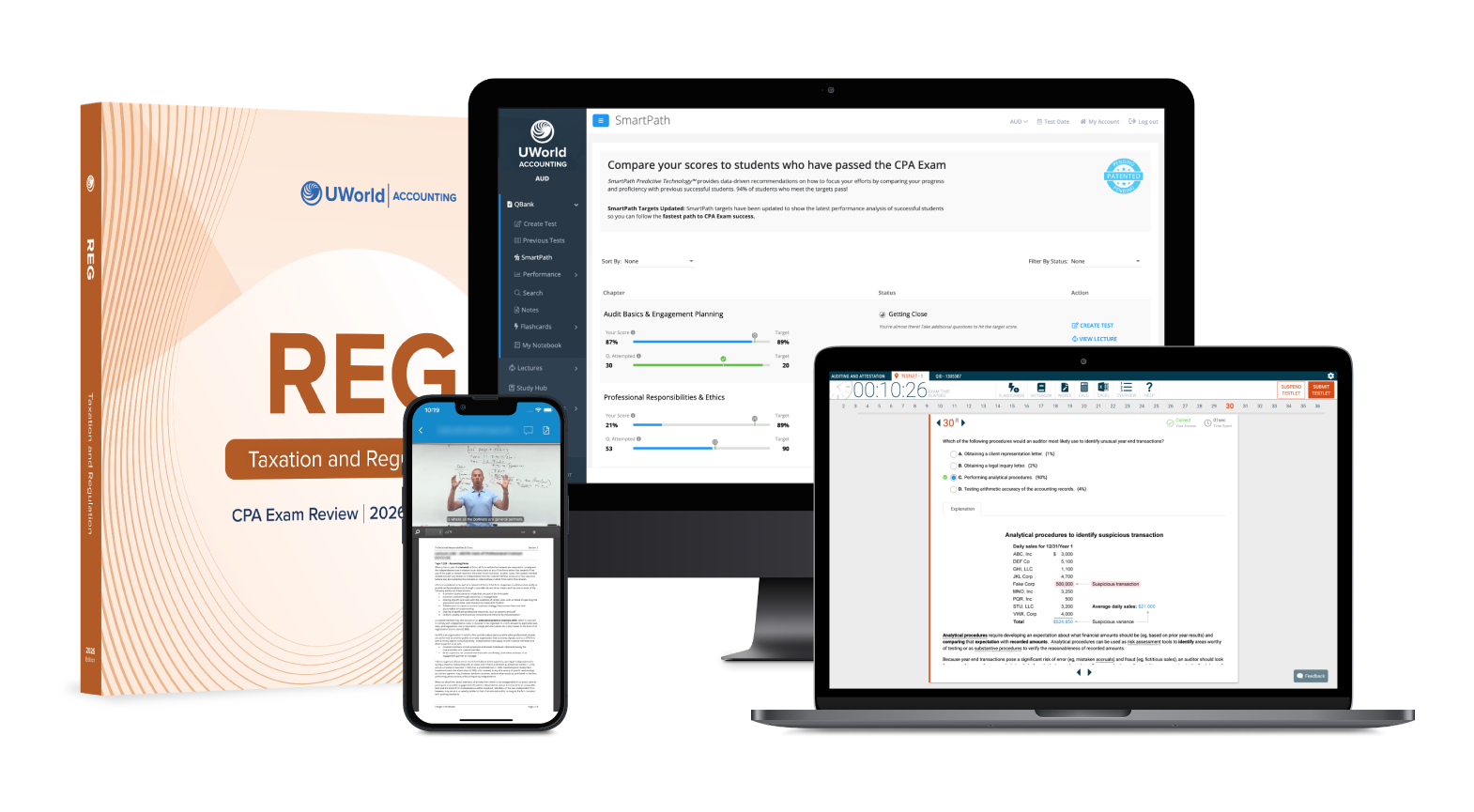

UWorld is home to an expert team of accounting educators and practicing CPAs, such as Roger Philipp, CPA, CGMA, and Peter Olinto, CFA, CPA (inactive), JD, who are committed to ensuring candidate success. We wondered why they chose to teach for UWorld, and here’s what these two industry legends had to say.

What are Ample’s US CPA Course Features ?

Our structured curriculum and experienced faculty make Ample one of the best CPA institutes in Bangalore for international accounting certification.

Secure your success with our proven roadmap designed to clear all four sections on your first try. Avoid costly retake fees and fast-track your path to a 20-40% salary hike.

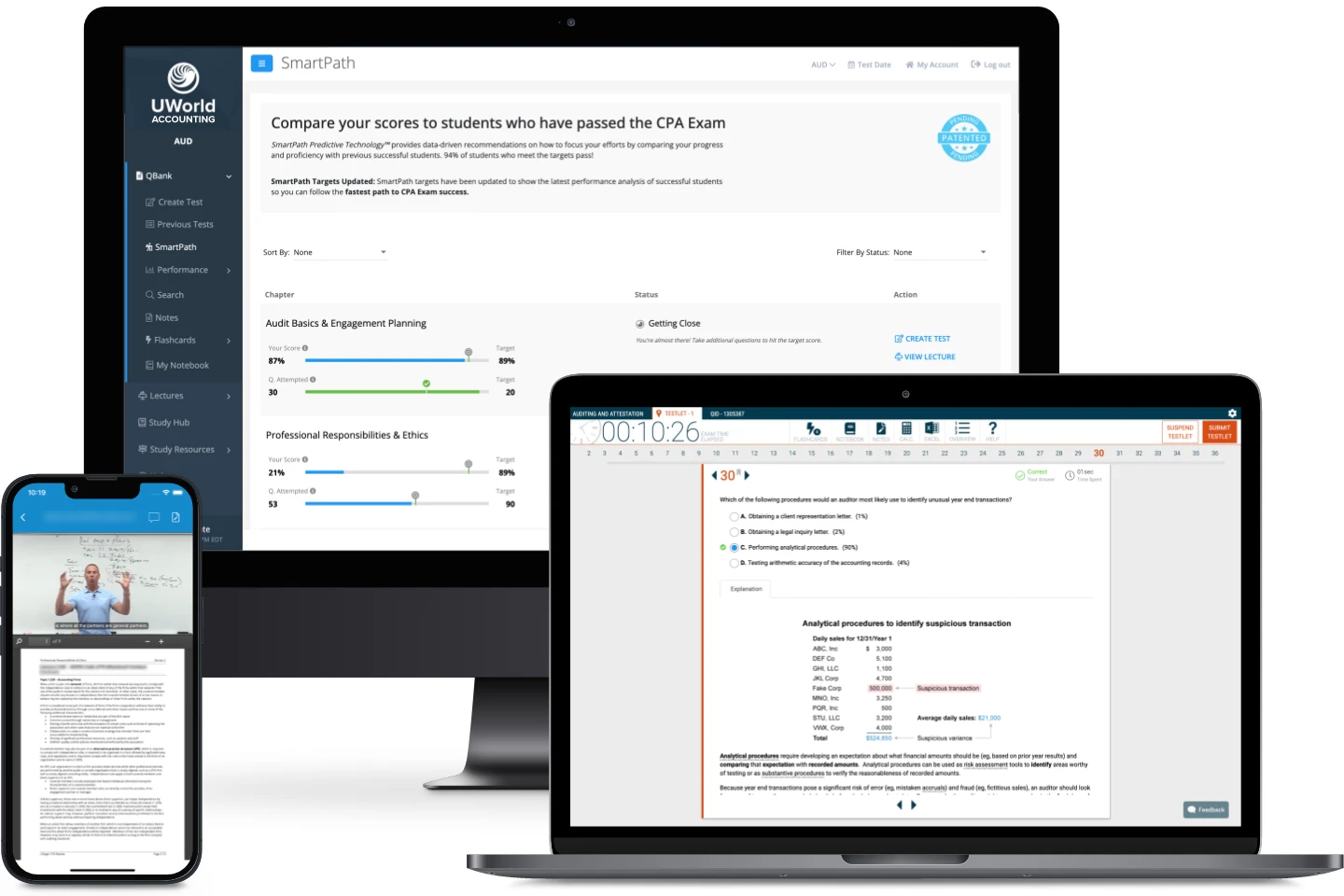

We provide the Globally Renowned UWorld CPA Review—built on the combined strengths of Roger CPA Review and Wiley CPA Review—that offers the ultimate path to CPA Exam success. Learn from legendary instructors Roger Philipp (CPA, CGMA) and Peter Olinto (CPA Inactive, JD, CFA), tackle expertly crafted questions, and join over 4 million candidates who have passed with UWorld.

Ample's exclusive study material (Ebook + Printed), which are pre-annotated and pre-highlighted - Access till you pass.

Access to Ample's Comprehensive LMS (Learning Management System).

Online instructor-led live training given by experienced and seasoned faculty like Mr Rohan Chopra, CPA, CMA & TEDx speaker.

We provide complete guidance & hand-holding through the US CPA Exam process with our dedicated Operations Team.

Enroll Now and Start Your CPA Journey Today!

U.S. Certified Public Accountant

Start your learning journey towards becoming a Certified Public Accountant (CPA) and elevate your career with the most sought-after and prestigious certification in the accounting field.

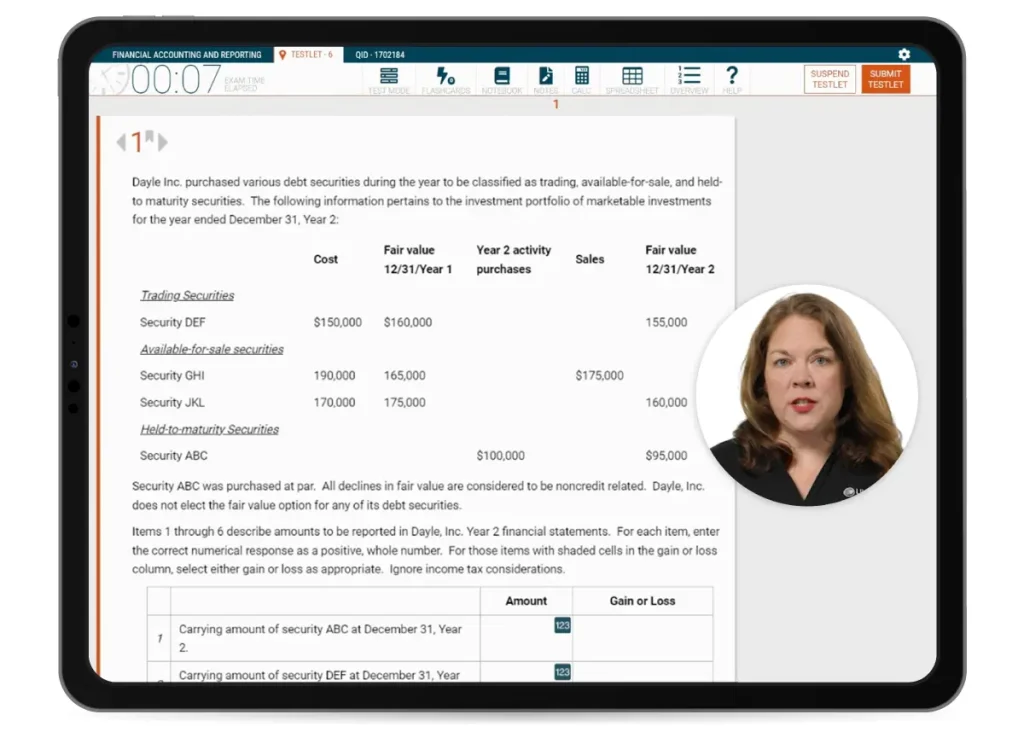

Auditing & Attestation – Complete CPA Exam Preparation Course

Master the concepts of Auditing & Attestation with our structured, easy-to-follow digital course designed for CPA exam success. Learn through expert explanations, practical examples, and smart study techniques that help you build strong fundamentals, boost confidence, and clear your exam faster.

Everything You Need to Clear the USCPA Exam

Stay exam-ready with annually updated U.S. CPA materials, perfectly aligned with AICPA Blueprints for smarter, faster preparation.

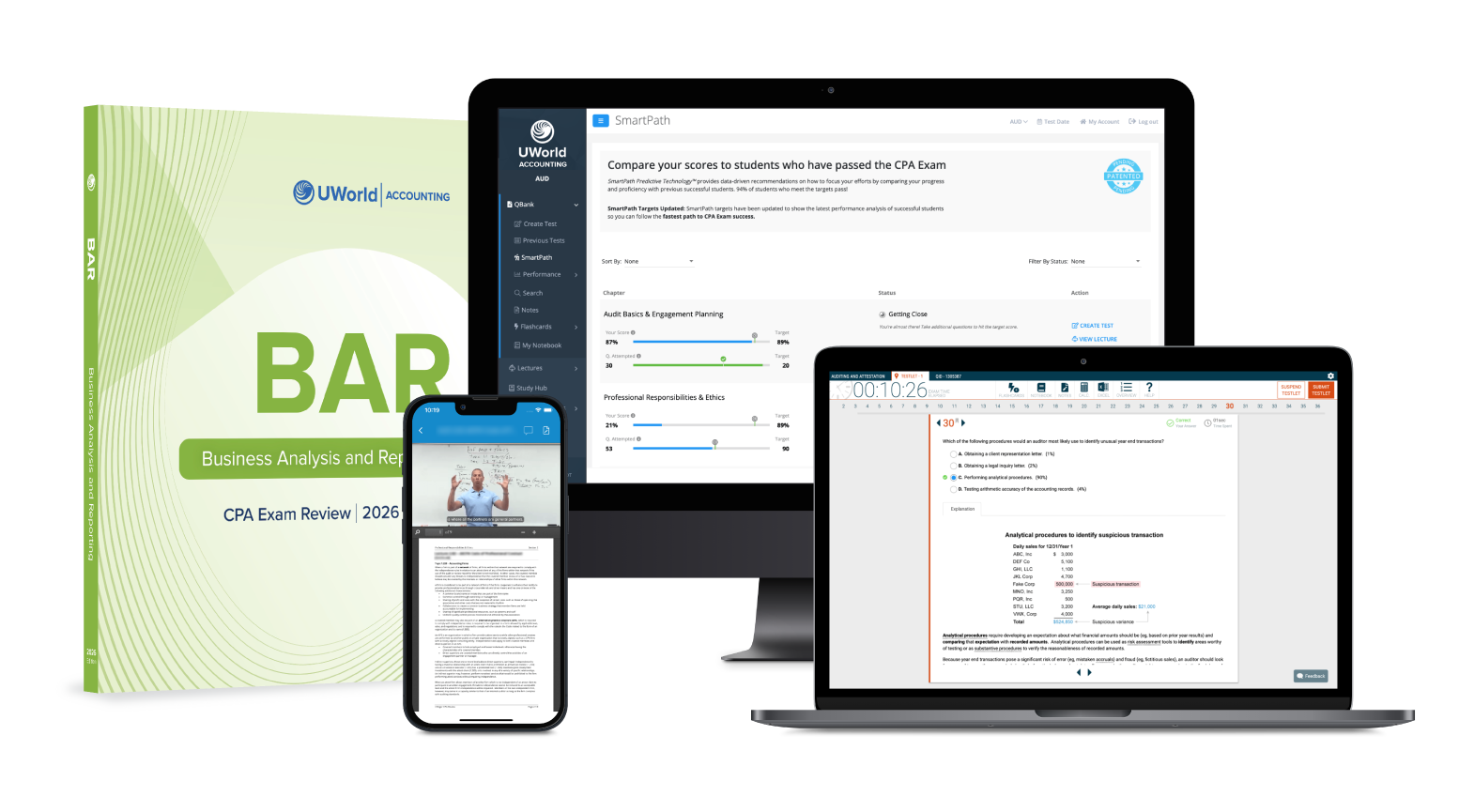

BAR – Business Analysis & Reporting Complete U.S. CPA Exam Preparation Course

Prepare for the U.S. CPA BAR section with our comprehensive, exam-focused learning system. Access expertly curated study materials, adaptive practice questions, real-time performance tracking, and multi-device learning support—designed to help you master concepts faster, improve accuracy, and succeed confidently on exam day.

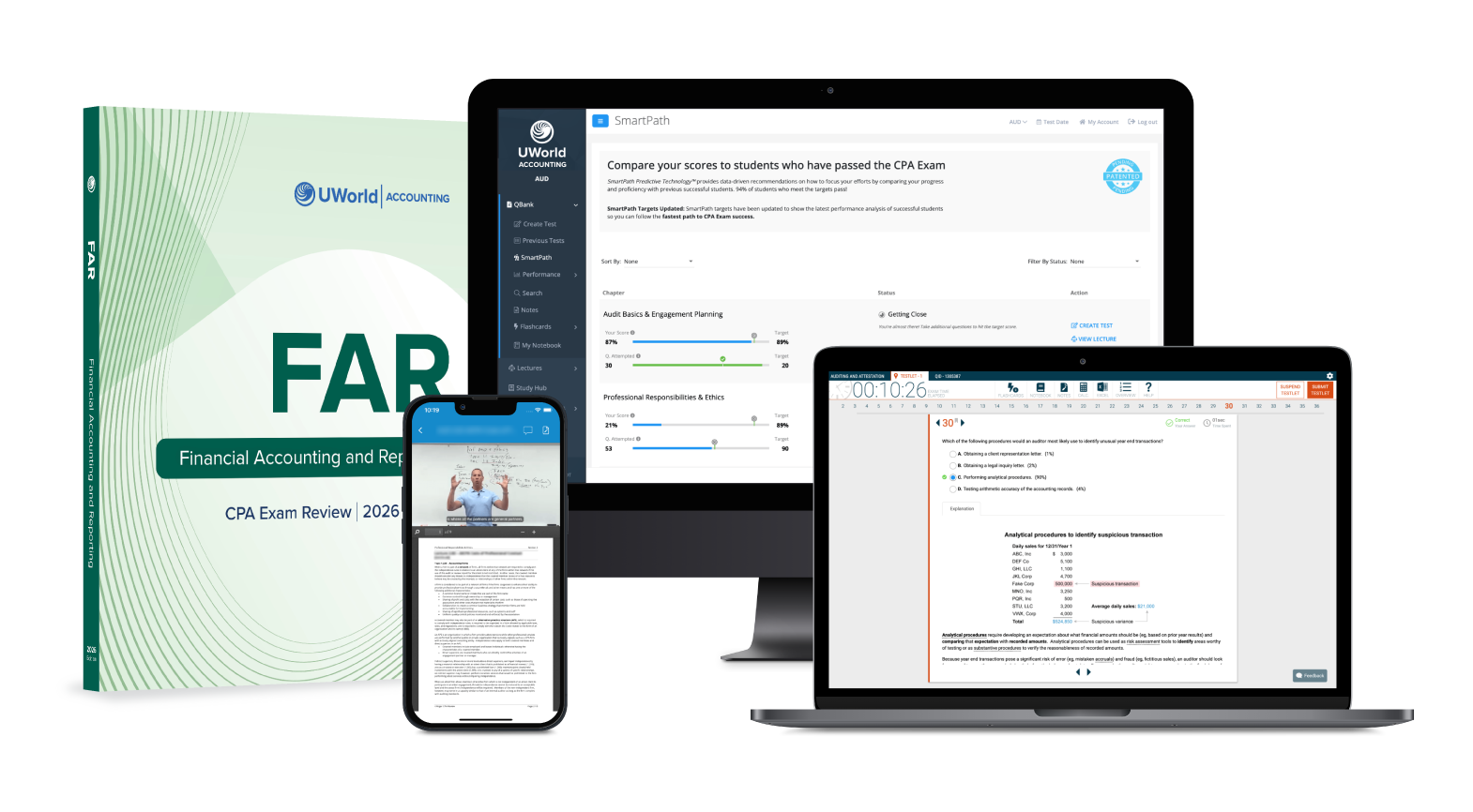

FAR – Financial Accounting & Reporting | Complete U.S. CPA Exam Preparation Course

Master the most comprehensive section of the U.S. CPA exam with our FAR course, featuring expertly structured content, adaptive practice questions, in-depth video lectures, and real-time performance analytics. Designed to simplify complex accounting concepts, strengthen problem-solving skills, and help you clear the FAR exam with confidence.

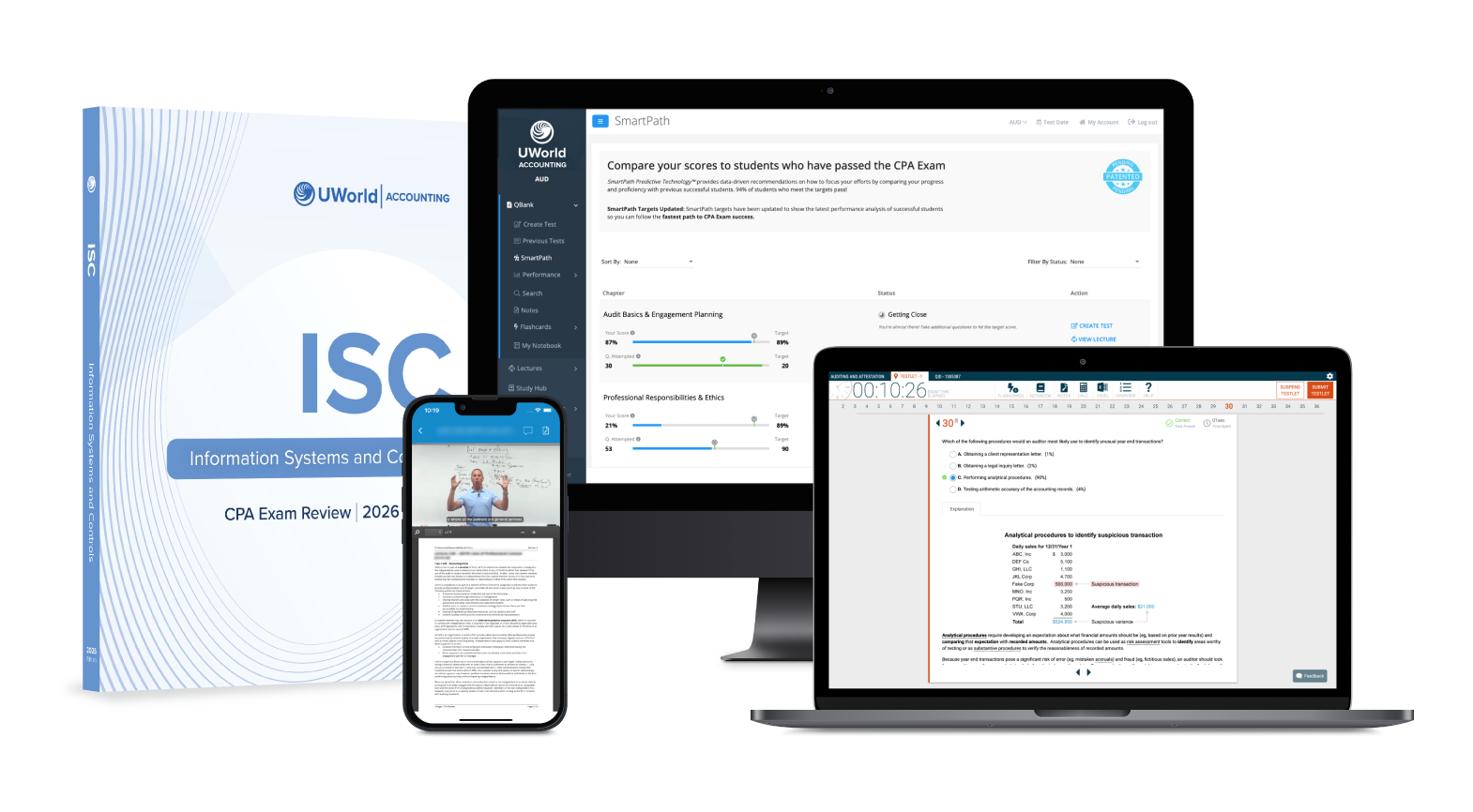

ISC – Information Systems & Controls Complete U.S. CPA Exam Preparation Course

Master the ISC section of the U.S. CPA exam with our expertly structured course covering IT governance, systems controls, data security, and risk management. Featuring adaptive practice questions, in-depth video lectures, and real-time performance tracking, this course is designed to strengthen your technical understanding and ensure exam-day success.

REG – Regulation (Taxation & Business Law) Complete U.S. CPA Exam Preparation Course

Prepare for the REG section of the U.S. CPA exam with our comprehensive course covering federal taxation, business law, ethics, and professional responsibilities. Featuring expert-led video lectures, adaptive practice questions, and smart performance analytics, this course is designed to simplify complex regulations and help you succeed confidently on exam day.

TCP – Tax Compliance & Planning Complete U.S. CPA Exam Preparation Course

Prepare for the TCP section of the U.S. CPA exam with our expertly designed course covering individual, business, and entity taxation along with strategic tax planning concepts. Featuring structured video lectures, adaptive practice questions, and smart performance tracking, this course helps you master compliance and planning with confidence for exam-day success.

About the U.S. CPA

Earning the globally recognized CPA certification enables you to work in specializations such as Auditing, Compliance, Taxes, Forensic Accounting, Fraud Examination, IT Systems, among many others.

Covering a broad spectrum of topics related to accounting and finance, the CPA exam assesses your ability to apply learned skills in practical real-world situations. The 2024 CPA Exam introduced a new Core-Plus-Discipline Model. This means that candidates must pass all three core sections and one discipline section of their choice. Candidates can choose the discipline section that best aligns with their career goals.

Core

Financial Accounting & Reporting (FAR)

Auditing & Attestation (AUD)

Regulation (REG)

Disciplines

Business Analysis & Reporting (BAR)

Information Systems & Controls (ISC)

Tax Compliance & Planning (TCP)

Explore Our Courses

We understand that studying for any professional-level/professional exam the CPA/CMA/CIA examinations can be a daunting task, which is why we’ve designed a comprehensive and flexible learning journey to help you succeed.

Live Online Classes

Offers an engaging experience virtually, allowing you to attend classes from anywhere in the world.

Self-Paced Packages

provide the ultimate flexibility, allowing you to study at your own pace and on your own schedule.

Requirements

You are eligible if you meet specific education, experience, and ethical requirements, and have passed the rigorous CPA exams. The following criteria should be met:

Bachelor’s Degree or higher with 90-120 credit hours, including specific accounting credits to appear for the exam

Minimum of 150 credit hours and 1-2 years’ work experience to apply for a CPA license

Exam Essential

Find the Right Path for Your Ambition

Financial Accounting and Reporting (FAR)

⏱️ 4 Hours

📑 50 Multiple choice questions & 7 Task Based simulation

Auditing and Attestation

(AUD)

⏱️ 4 Hours

📑 78 Multiple choice questions & 7 Task Based simulation

Information Systems and Controls (ISC)

⏱️ 4 Hours

📑 82 Multiple choice questions & 6 Task Based simulation

Regulation

(REG)

⏱️ 4 Hours

📑 72 Multiple choice questions & 8 Task Based simulation

Business Analysis and Reporting (BAR)

⏱️ 4 Hours

📑 50 Multiple choice questions & 7 Task Based simulation

Tax Compliance and Planning (TCP)

⏱️ 4 Hours

📑 68 Multiple choice questions & 7 Task Based simulation

Examination Date

Core Section Tests are administered throughout the Year, Monday-Friday, 8:30 a.m. to 5:00 p.m. & the Discipline Section Exams are administered per the above Table.

July 1-31, 2025

October 1-31, 2025

January 1-31, 2026

April 1-30, 2026

Frequently Asked Questions

Ample Training Institute is widely regarded as one of the best choices for CPA aspirants in Bangalore.

It proves global expertise in accounting, auditing, taxation, and reporting. Making it one of the most respected finance certifications.

The very basic US CPA eligibility criteria follow up with a Bachelor’s degree, 120 credit points, including 24 Accounting credits. Moreover, one requires 150 Credit points to get the license alongside work experience of 1 year.

Approx. INR 3,45,482 (registration, materials, coaching, exams).

Around 40–60% per section; only 20% clear all four parts in the first attempt.

Yes. The US CPA Exam is complex, with low pass rates, but not impossible to clear.

Use AICPA-approved: UWorld, Becker, Surgent, Ninja, Gleim.

You can get access to the 2025 US CPA Syllabus and all the necessary updates on the US CPA Evolution Model at the NASBA & AICPA websites or simply google AICPA Exam Blueprints and download the pdf from official AICPA website

3 core: Audit, Tax & Business Law (REG), Financial Accounting & Reporting (FAR) + 1 discipline elective.

Ample Training Institute offers expert-led sessions, unlimited access, mentorship, and real-time support.

Both are AICPA-approved. UWorld offers lifetime access & free updates; Becker often requires renewals.

US CPA Exams are conducted at Prometric Centres located in Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum, in India.

CPA Student Catalog

The student catalog provides program and course descriptions, academic policies, repeat and refund policies.